In the mid 1980s, when the railroads were pruning many of their less-profitable-than-their-stockholders-liked lines, venture capitalist railfans in Chicago decided to get into the business and rake some of the money in some of them into more deserving pockets. The Illinois & Michigan Railroad was created by, in 1984, purchasing the Port Huron & Detroit, and then, since Conrail was enthusiastically divesting themselves of duplicate lines, assembling a mainline from (approximately) Chicago to (approximately) Detroit from purchased trackage (including the Chicago South Shore & South Bend from the bankrupt Venango River Corporation, the Michigan Southern, and the southern section (Ann Arbor to Toledo) of the Ann Arbor Railroad from the bankrupt Michigan Interstate Railway), trackage rights, and new construction (notably from Niles, MI to New Carlisle, IN to avoid a slow urban connection between the ex-Michigan Central in Niles and the CSS&SB in Bendix, IN) and operating all of these lines under the umbrella of Groupe I&M (operating as the I&M group at that time.)

Conrail was, of course, delighted to sell this trackage to a shortline, because they (accurately) guessed that the operators would overextend themselves and go bankrupt. Which they eventually did; the owners went on a buying spree by purchasing used SD70s, C40-8s, and new locomotives from ILW, and then upgrading their Michigan mainline to 60mph standards, which left them with a debt load in the tune of US$200 million.

The railroad lasted 27 years, originally as a pretend-competitor to Conrail, then as a bridge line to connect the D&H (via the Ontario Southwestern) into the hub of Chicago, and then the US economy badly hiccuped in 2017, through traffic dropped considerably and they were no longer able to service their debt load.

The obvious (and stupid, but railroad managements are pretty reliably stupid when it comes to operating margins) thing to do at this time would be to slash costs by deferring maintenance & laying off large chunks of the workforce, and that’s what the I&M Group announced they were going to do. But the Delaware & Hudson (10% minority owner) and LT&L (also a 10% minority owner via the OSW) strongly disapproved of that sort of stunt on their partner on the normally lucrative (and very competitive) bridge traffic from the east, huddled with the Parsons Vale board, and launched a takeover bid on the railroad. The competing railroads (Norfolk Southern, CSX, and the CN) were too busy chasing operating margins to want to bid against the (not doing stock buybacks, thanks to the union-heavy) Parsons Vale trust, so at the cost of “only” $100 million dollars the D&H & OSW walked away with control of Groupe I&M.

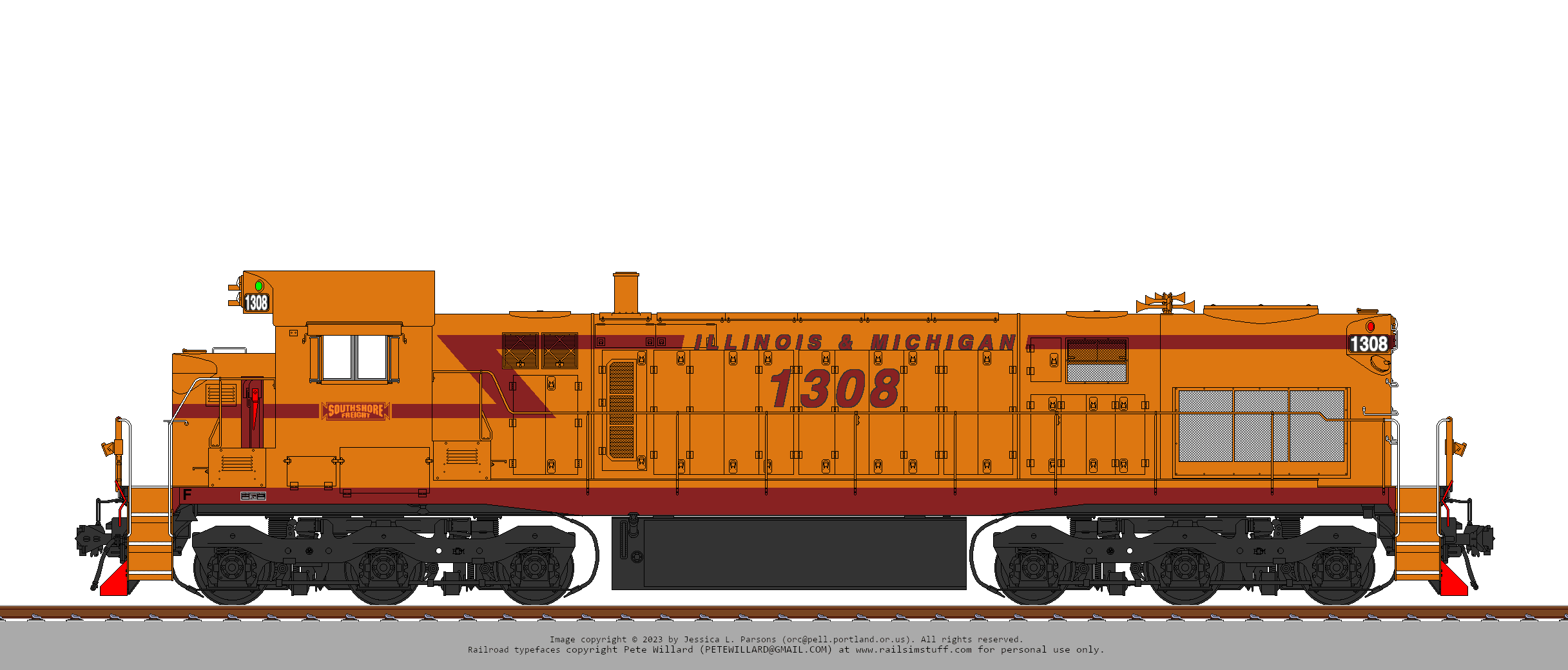

After the purchase, all of the EMDS (8 on the CSS&SB, 8 on the AA, 6 on the I&M, and 2 on the MSO) and the 6 I&M GE’s were put on the market and replaced with some of the pile of DL16s that arrived in 2013, plus newer power that used to operate on now-electrified sections of the LT&L & P&W.

Some pruning of the I&M’s network has happened since the takeover:

- the branch to Vicksburg, MI, which had never developed any sort of traffic base, was embargoed when the COVID-19 plague struck in 2020.

- the ex-Big Four branch between South Bend & Niles has been sitting unused since the late 1990s (not abandoned because the city of South Bend has been making (unserious) noises about running mass transit directly up to Niles, so the I&M is perfectly happy to leave the line intact as long as they don’t have to pay taxes on it.)

- The PH&D is now a subsidiary of the GFM.

- The CSS&SB is now a subsidiary of the PV&T.

- The Ann Arbor is now a subsidiary of the OSW.

- And the MSO & I&M are now subsidiaries of the CSS&SB.

Until 2023, the mainline between the Chicago & Detroit was an essential part of the D&H’s western bridge line, but after the CTRC’s tunnel under the St Clair was opened the line was split into two separate segments; Niles to Jackson & Manchester to Ann Arbor (the latter segment has been sold to the Ann Arbor.)

As of 2024, the I&M only rosters a single eco-642 locomotive for MOW & rescue service – all other traffic is handled by CSS&SB, CTRC, OSW, and D&H motors.